Agra Nagar Nigam Property Tax, Online Guide, Management System

Aadil Saif 11 January 2021

Agra Nagar Nigam Property Tax Online

The city of “The Taj” attracts national and international tourists and to maintain the city, Agra Nagar Nigam levies property tax so that the best of the infrastructure facilities and other amenities can be provided to the residents of the city and to those who come to Agra to witness its rich culture and heritage. Whether it is the offline or online mode of payment of property tax, Agra Nagar Nigam is the local body which is responsible for the tax collection.

What are the Documents Required for Property Tax Payment?

- Assessment number (which is the unique number for every property)

- Old assessment number

- Name of the owner

- Address of the property

- AADHAR card

The assessee must be 18 years and above and should have a property in his/her name to pay the property tax on the building owned.

How is the Property Tax Amount Calculated?

The property tax has to be paid annually and the location of the property is the prime determinant for collecting the fees and the other factors are:

- Basement area

- Occupant type (tenant or owner)

- Age of the building

- Usage of the property (residential or commercial)

- Rate prevalent in the street where the property is situated

How Can the Property Tax payment be Made Online in Agra?

By visiting the official website of Agra Nagar Nigam, the taxpayer can make the tax payment online. This doesn’t mean that the offline mode ceases to exist.

To pay in person the procedure is:

- Obtain the application form from the Municipal Corporation and fill in the details in the respective sections.

- Attach the documents which have been mentioned in the application form.

- The authorities will assess the form and you will have to submit either cash/DD/challan.

- Once you deposit the amount, a receipt will be given which can be used as a proof of the tax so paid.

Agra Nagar Nigam Property Tax To Pay Online:

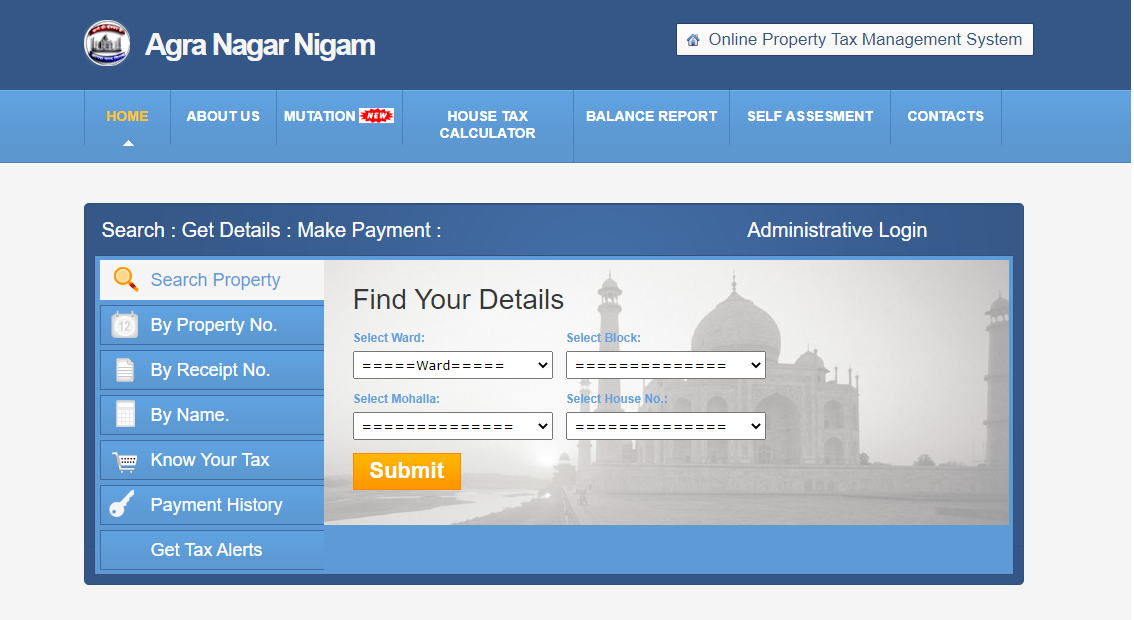

- Logon to www.nagarnigamagra.com. You will need your property ID or assessment number to go further.

- You need to select “Pay Property Tax Online” and this will transfer you to a page where you will get the option of paying the tax online.

- Fill in the details like ward, block, street and the house number and click on the Submit tab.

- Once you do this, you will be directed to the page where you will have to select the mode of payment. Enter the details which can be debit/credit card details or net banking transfer details and confirm the payment.

- A receipt will be generated which can be used for future reference.

Agra Nagar Nigam Property Tax Offline Payment

You have another option too. You can download the application form of self-assessment of the property tax return. There are both online and offline modes of payment of your property tax.

You should fill self-assessment form with every detail like name of the owner, his address, the number is given to the property, etc. now you can submit the form with deposition of tax in the office of Corporation or Nigam. They will give you the receipt that will be used for future reference.

For any information on property tax you can visit Agra Municipal Corporation, Near Sur Sadan, M.G.Road, Agra. You can also mail your queries at amcagra@yahoo.com or you can also call at the toll-free helpline number which is 1800-180-3015.

Payment of property tax is your duty as an ideal citizen and any negligence on your part will attract penalties. To avoid being in such situations, pay the tax and let your city shine and gleam.

Get in Touch With us

Register here and Avail the Best Offers!!