NMMC Property Tax Online Payment, Online Guide, Calculate (NMMC) Tax Rate

Aadil Saif 15 February 2021

NMMC Property Tax Online Payment is one of the modes of paying property tax to Navi Mumbai Municipal Corporation which is responsible for collecting the property tax in Navi Mumbai. NMMC came into force on 1st January 1992 and since then; it has been responsible for the collection of property tax on the rateable value of the property. This method of tax collection has replaced the old method of tax collection by Gram Panchayats which was ineffective and unfair. Apart from paying property tax via online mode, the residents have the option of paying various utility bills as well on this platform. Navi Mumbai Municipal Corporation is divided into 8 nodes in the city which are further segregated into groups and from groups the division goes down to blocks. There are 111 electoral wards in the city and from each ward one corporate is elected who serves as the guiding light for the residents of that ward. The Commissioner heads the property tax department and the ward office is taken care of by the ward officer.

How is Property Tax Collected by NMMC?

When you logon to the website of NMMC you will get an option called “Services”. By clicking on this, the taxpayers will be directed to the page where you can choose Property Tax and you will directly go to the property tax home page. From here, choose “Method for fixing rateable value” and you will be able to access the various parameters on which the tax is determined for commercial and non-commercial properties.

As far as commercial properties are concerned, the property is valued at Rs 65 per 20 sq meters. And this is Rs 1300 monthly. The annual value of the tax is Rs 15,600 and a 10% statutory deduction from this amount makes the rateable value Rs 14040. The tax rate is 68.33% of this amount for 20 sq meters.

For residential or non-commercial properties, the property is valued at Rs 20 per 50 sq meters and this is Rs 1000 monthly. The annual value of the tax is Rs 12000 and a 10% statutory deduction from this amount makes the rateable value Rs 10800. The tax rate is 38.67% of this amount for 50 sq meters.

What are the steps of NMMC Property Tax Online Payment?

- Logon to the official website of NMMC which is http://www.nmmc.gov.in

- Once you are here, click on the “Online Tax Pay” tab. This will take you to a new page for the payment of tax.

- Enter the property code and click on the Search button for the payment of tax. Once you do this, you will get all the details like the name of the owner, mobile number, address, etc. on your screen. Check all the details to avoid any confusion.

- Once you have cross verified the information, select the payment option and you can choose net banking or debit/credit card, and make the payment of the property tax due against the property you own.

- Transaction reference number so generated can be used for your records.

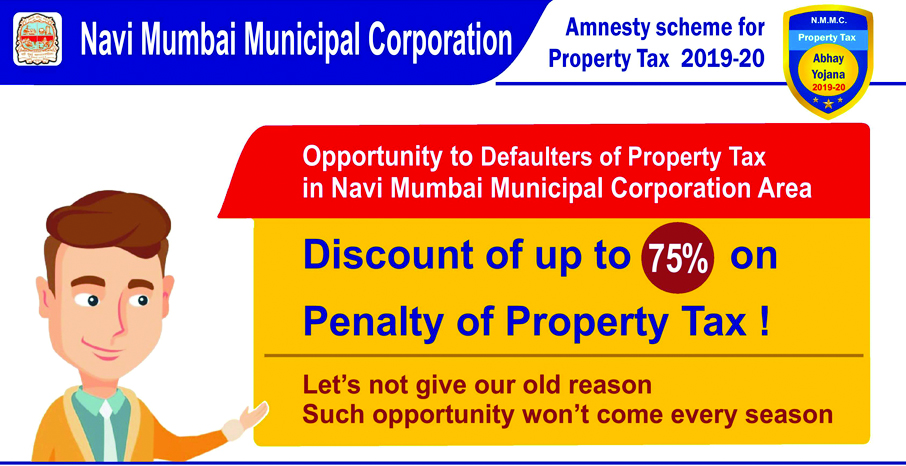

NMMC Property Tax Online Payment has simplified the tax payment process and thus it is the responsibility of the property owners to be regular in tax payment to avoid any fines and penalties.

Get in Touch With us

Register here and Avail the Best Offers!!