Pimpri Chinchwad Municipal Corporation - PCMC Property Tax Calculate, Online Payment, E-receipt

Arun Kumar 10 May 2022

A Detailed Guide about PCMC Property Tax

This is due to the large number of multinational manufacturing units that have set up shop in PCMC, making it one of the wealthiest municipal corporations in India. As a result, the area has become a famous real estate market for workers employed in the area's manufacturing facilities. Several housing societies and townships have grown up, with PCMC providing the essential infrastructure to support their development. Property owners must pay PimpriChinchwad half-yearly (PCMC property tax), which can be done online. For the first time, PCMC property tax was collected digitally.

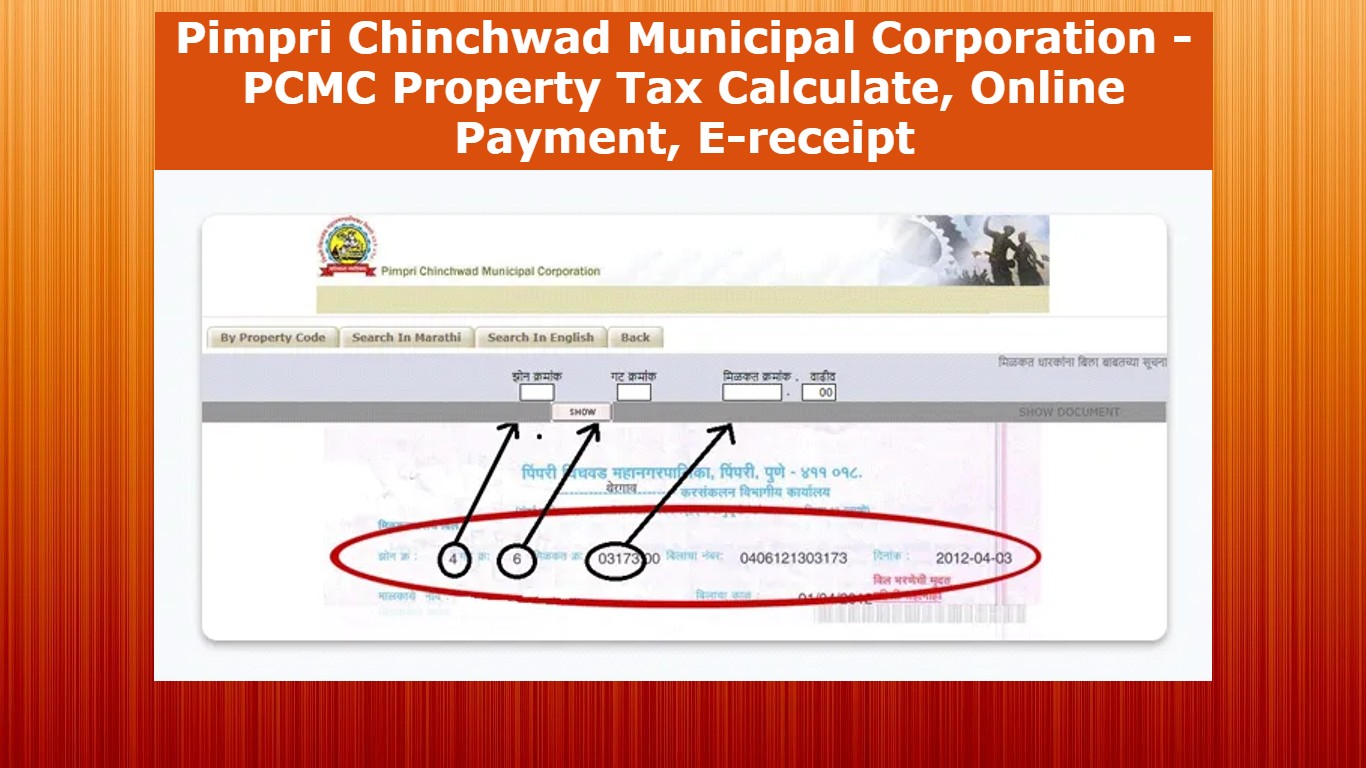

The property tax for the PCMC can be paid in two ways. One option is to pay by DD, cash, or ATM cards at a PCMC office in your area. You can also pay online through PCMC's official site, the second option. The PCMC property tax can now be paid online, saving you 5% off the General Tax rate. When you pay PCMC property tax online, you'll receive an e-receipt, be able to look up your previous pcmc property tax bill 2022-23, and have access to all of your past data. A Zone Number, a Gat Number, and an Income Number are all required for PCMC property tax online payment.

The following are the steps to make an online payment for PCMC Property Taxes in 2022.

Step 1: There are several ways to get started with property tax payments.

Step 2: Second, under Resident, choose "Property Tax," which will direct you to the Pune property tax website.

Step 3: By selecting "Property Bill," you'll be taken to a search screen where you can enter your personal and financial information.

Step 4: To find out about your property taxes, do pcmc property tax search by name or type your Gat No. and Zone into the search box.

Step 5: After choosing "Show," the amount of your property tax bill payment will be displayed. Use pcmc property tax online bill payment option.

Step 6: Enter your phone number and email address in the 'Make a payment option.

Step 7: To complete the transaction online, select a payment method.

Using Paytm to make PCMC property tax payments

To pay your PCMC property tax bill for 2021-22 online using Paytm, follow these steps:

- Select a business.

- Just put in your contact info like a phone number and email address if you have them.

- Select 'Get Tax Amount.'

- To pay taxes, you can use a debit or credit card or a net banking account,

- A Paytm wallet or a UPI account (UPI is only available with the Paytm app).

- Make the payment, and you're all set.

E-receipt for property taxes from the PCMC

Immediately after you pay your PCMC property tax bill, you will receive an e-receipt. If the payment cannot be completed or a receipt is not issued as a result of connectivity or technical issues, check your bank account for a refund. If your bank account has been debited, but no receipt has been generated yet, you can check back in three business days to see if the transaction was successful. The receipt for your PCMC property tax bill may be found on your property details page, just below the 'Make Payment' button.

Critical Remarks Regarding PCMC Property Tax Online Payment

Suppose a receipt is not generated for a PCMC property tax online payment due to technical difficulties. In that case, it is recommended that you check to see if the amount has been debited from your bank account before proceeding.

If the amount is not debited from your account, you can repeat the payment process until the problem is resolved.

If the amount is debited but no generated receipt, check back later to see if the situation has changed. The receipt will be available for download within the next three business days.

PCMC's property tax bill can be viewed online.

Step 1: Enter your address into the PCMC Property Tax portal and select 'Property Bill' from the drop-down menu.

Step 2: Use a search engine to find out more about your property's specifics after entering the zone number, Gat number, and owner's name.

Step 3: To view your PCMC property tax bill, click on the 'Show' option.

Using your PCMC property tax bill, look for the section titled "Total.

Step 4: "The Amount to Be Paid" (Amount with Concession-Fajil Amount). You'll be required to make a PCMC online payment of this amount from April through September.

How to calculate PCMC property tax?

Step 1: On the official website of the PCMC, you can use a pcmc property tax calculator to figure out how much property tax you owe for your home in the PCMC area. To figure out your PCMC tax, follow these steps:

Step 2: Take a look at PCMC Property Tax-Self Assessment.

Step 3: If you're a resident, NRI, or commercial property owner, you'll need to select a zone from the drop-down menu and scroll down.

Step 4: The amount of property taxes due will be determined for you.

Changing a property tax record's name is a simple process.

If you have all the required paperwork, changing your name on your PCMC property tax record is as simple as filling out a form. Take note of the following documents for pcmc property tax name correction:

- The most recent property tax bill.

- This should be an attested photocopy of the sale contract.

- No objections certificate from the housing society.

- The property tax office has an application form that you can fill out.

In addition to the required documents indicated previously, applicants should complete an application and send it to the Commissioner of Revenue at the PCMC office together with the appropriate documentation. The application will be verified using pcmc property tax app, and the records will be updated within 15-20 working days of submission.

Refunds for PCMC's Property Taxes

For properties owned by women and former military personnel, PMC offers tax rebates. Ten percent of the tax due is waived for taxpayers who pay their property taxes in full between April 1 and May 31 for taxes up to Rs.25, 000, and five percent of the tax due is waived for taxpayers who pay more than Rs.25, 000. During a year, this percentage can rise to 24%. The taxpayer must pay property tax bills by June 30 each year to avoid a pcmc property tax penalty.

Concession on PCMC's property taxes.

If you pay your property tax in one lump sum, PCMC will give you a 10 percent discount on your General Tax payment. Furthermore, when you pay your PCMC property tax online, you will receive a 15 percent discount on the General Tax.

Conclusion

A few types of properties are exempt from property tax. This includes places of worship, burial or cremation, and lands of historical significance. Using a building for charitable, educational, or agricultural purposes is not the only reason for its exemption from property taxation. Residential structures under 500 square feet have also been exempted from property taxes under the jurisdiction of PCMC. Over 1.5 lakh households in the area will benefit from this move.

FAQS

1. How much is the property tax in PCMC?

Using a percentage of the property's actual value, the PCMC determines how much to charge in property taxes. If you pay all of your property taxes by June 30 of the current fiscal year, you'll receive a 10% general tax discount from Pcmc.

2. What is the due date for payment of property tax in Pune?

The payment is due on May 31 for the first half of the year, which runs from April 1 to September 30; the payment is due on December 31 for the second half of the year, which runs from October 1 to March 31, and the payment is due on May 31 for both halves of the year.

3. How do I get a PCMC property tax discount?

If you own a home, a piece of land, or a business, you may be entitled to a tax refund. Learn more here. If the rateable value of the estate is less than Rs. 25,000/-, you will be eligible for a 10 percent reduction in the general tax rate.

4. What is the average property tax in Pune?

Assessing a property's worth and collecting property taxes in Pune is done by either the Pune Municipal Corporation or the PimpriChinchwad Municipal Corporation, depending on where a person owns the property. Property taxes are PMC's second-largest revenue source after Octroi, which it has collected since 1950.

The owner's tax bill is calculated by multiplying the property's fair market value by the current tax rate.

5. What is the last date to pay property tax in PCMC?

The pcmc property tax last date 2022is May 31, and the deadline for the second half of PCMC payments is December 31, with both deadlines being the same.

6. How can I check my property tax online in Pune?

Create an account with your phone number and email address on the Pune Municipal Corporation's website by visiting the link below. For further information, you'll need to enter your property ID.

7. How is property tax calculated in Pune?

The Pune Municipal Corporation provides an online property tax calculator. The calculator uses the following data:

Location of the property and the type of use

- Plinth in its entirety

- Construction Started In Year

Get in Touch With us

Register here and Avail the Best Offers!!