Understand The Background Of Chennai Property Tax Online Payment Now

Aadil Saif 21 December 2020

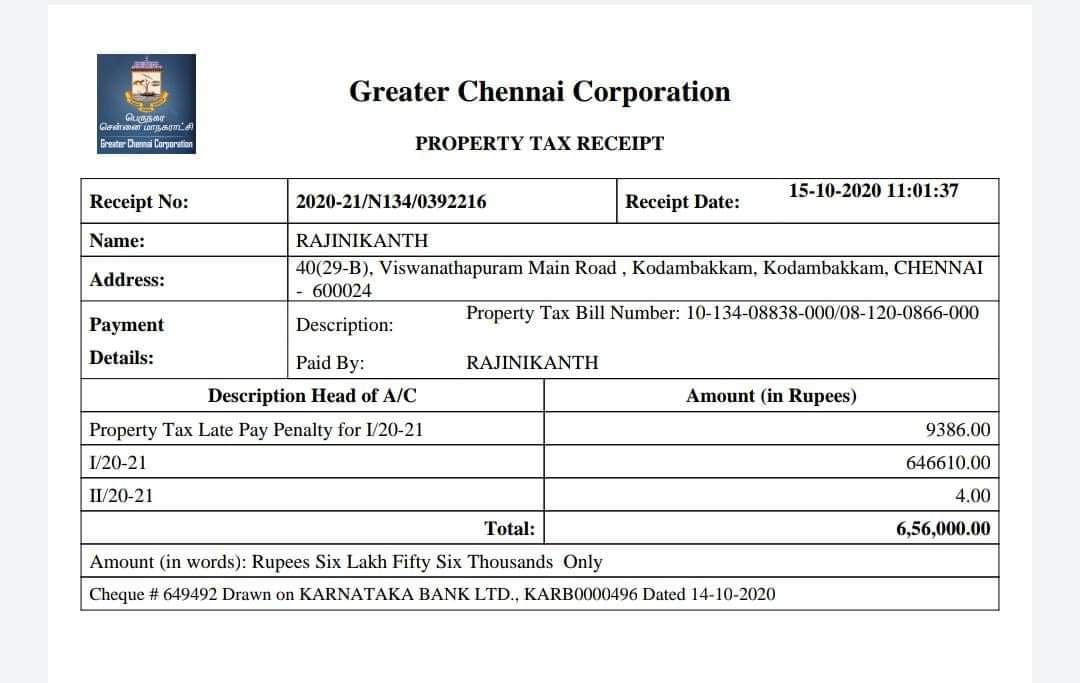

Chennai Property Tax Online Payment

Chennai property tax online payment has revolutionized the entire concept of the payment of property tax which is one of the major sources of revenue to the government. Also known as sotthu vari, property tax is levied on commercial or residential buildings, and the amount collected is used for the development of infrastructure and public amenities in the city. The Greater Chennai Corporation is responsible for the collection of property tax in Chennai and to ease the process for the assessees the Chennai Municipal Corporation has been segregated into 15 zones and thus depending upon the zone in which your property is, you are required to pay the property tax.

What is the basis for the Calculation of Property Tax in Chennai?

Reasonable Letting Value (RLV) is used as a basis to arrive at Annual Rental Value and this, in turn, is the basis on which the annual or half-yearly Property Tax is Calculated in Chennai. Depending on the locality, the basic rate per sq. ft is ascertained by the Municipal Corporation and it is with reference to this rate that monthly RLV is calculated. For residential properties, the basic rate per sq ft falls between Rs 0.60 per sq ft-Rs 2.40 per sq ft and for non-residential properties, the basic rate per sq ft is Rs 4 per sq ft-Rs 12 per sq ft. The due date for the payment of property tax every year is September 31 and March 31 and any default in the payment attracts a penalty of 1% every month.

How can the property tax be paid in Chennai?

Chennai online property tax payment has brought oodles of convenience to the taxpayers because they can sit at home and make the payment without facing the ordeal of going to the Municipal Corporation. But that doesn’t mean that the offline mode has ceased to exist. Thus, the two ways in which the property tax payment can be made are:

Offline mode: The assessee needs to fill the application form and submit it with a DD/Cheque in the favour of “The Revenue Officer, Corporation of Chennai” and the payment can be made through tax collectors, E-Seva centers which have been set up the Tamil Nadu government, Tamil Nadu Arasu Cable Television Corporation which has been developed in Taluk offices in the district of Chennai and authorized banks like City Union Bank, Indian Overseas Bank, HDFC, IDBI, Karur Vyasa Bank, Tamilnadu Mercantile Bank, and IndusInd Bank.

Chennai property tax online payment: The process for online payment of property tax is however very simple and the steps are:

- Logon to www.chennaicorporation.gov.in which is the official website for the payment of property tax in Chennai. Under the “Online Civic Services” section, select the “Online Payment” option.

- Fill in the required details like your ward number, zone number, bill number, etc, and click on the submit button. These details will be mentioned on the bill and thus it won’t be a problem to fetch the necessary information.

- After this, you will be directed to a page which will show the amount outstanding against the property. Choose “Pay online option” and select the method of payment which can be fund transfer or payment through debit/credit card.

- You will receive an acknowledgement of the payment done which you can save for your future reference.

- In case you face any difficulty in making the online payment, you can call at 044-25619258 and get the issue resolved.

Timely payment of property tax will save you from the penalty and thus it is advised to be pro-active in fulfilling your obligation as a responsible citizen regarding payment of taxes.

Get in Touch With us

Register here and Avail the Best Offers!!