How to Pay KMC Property Tax Bill Online

Aadil Saif 02 January 2021

How to Pay KMC Property Tax Bill Online?

KMC property tax online payment has eased the work of the taxpayers as they no longer need to stand in long queues at the Municipal offices to pay the tax. People owning residential properties cannot escape from their duty of paying the property tax and it is from that amount so collected that the regular maintenance of the infrastructure facilities in the city is carried out. In Kolkata, Kolkata Municipal Corporation (KMC) collects the funds and thus uses them in the best interest of the citizens of the city.

When was KMC property tax online payment system launched?

Kolkata Municipal Corporation had launched the online portal for tax payment in 2010 and the software for the same was designed by TATA Consultancy Services. The cost of the project was Rs 2 crores and the same was funded by the Department of International Development, UK. In 2016, with the rolling of Kolkata Municipal Corporation (Amendment) Bill, the procedures to make online payments were further simplified and became more transparent. It allowed for self-assessment of the assessee’s property-tax amount and also gave power to KMC to increase or decrease the amount of tax. In 2017, the Annual Rateable Value System was replaced by the Unit Area Assessment System which has removed subjectivity and confusion.

What is the Unit Area Assessment System?

- Under this system, the city has been segregated into 293 blocks and 7 categories from A-G. This division is based on the market value of the property, infrastructure and facilities in the area.

- Annual value per square feet is assigned to each category with category A having the highest BUAV (Base Unit Area Value) and category G has the lowest value.

- This system has covered around 6 lakh property taxpayers in Kolkata and has tried to bring uniformity in the tax payment system. Slum areas fall under category G and Refugee Rehabilitation Colonies and government schemes launched for economically weaker sections come under category E.

What is the formula for property tax calculation?

Annual tax=BUAV*Location Multiplicative Factor (MF) Value*Covered Space/Land Area*Usage Multiplicative Factor Value*Age MF value*Occupancy MF value*Structure MF Value*Tax rate

How to pay KMC property tax online?

The taxpayer should know the assessee number and registered mobile number to avail of the online tax payment service. The steps for online tax payment are:

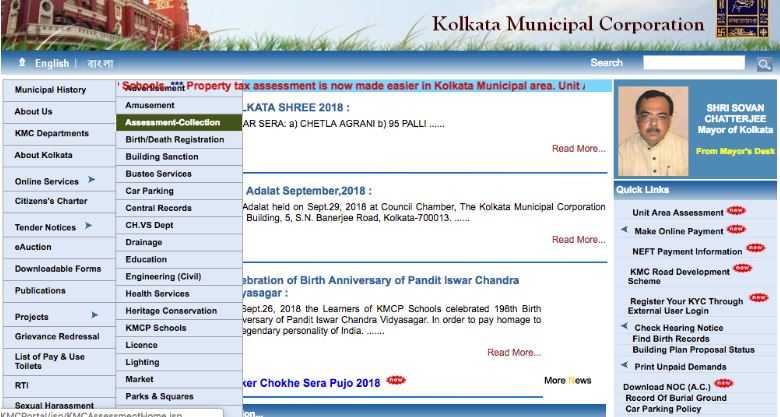

- Logon to the official website of Kolkata Municipal Corporation and follow the link which is https://www.kmcgov.in/KMCPortal/HomeAction.do do?

- This will direct the user to the main page of Kolkata Municipal Corporation and various options will be displayed on the right-hand side from which the taxpayer should click on the “Online Payment” option.

- Click on Property Tax and you will further get three options.

- If you are filling the tax for the first time, you will have to punch all the details like assessee number, contact number, etc. Once you have done this, click on the Pay option.

- You will be directed to the payment gateway from where you chose how you have to make online payment of the property tax. It can either be through net banking or debit/credit card. Choose the desired method and make the payment.

KMC property tax online payment has facilitated a quick collection of tax and has brought much ease to the taxpayers.

Get in Touch With us

Register here and Avail the Best Offers!!